everett wa sales tax 2020

Book an appointment on Fridays or. Businesses making retail sales in Washington collect sales tax from their customer.

Washington Sales Tax Small Business Guide Truic

Use this search tool to look up sales tax rates for any location in Washington.

. Quarterly tax rates and changes. The minimum combined 2022 sales tax rate for Everett Washington is. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington.

The Everett Washington sales tax rate of 99 applies to the following five zip codes. Groceries are exempt from the Everett and Washington state sales taxes. This would happen if a vehicle was purchased from a private party or if it was purchased outside of Washington.

Everett is located within Snohomish County Washington. One of a suite of free online calculators provided by the team at iCalculator. A retail sale is the sale of tangible personal property.

Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 31. The Everett sales tax rate is. Tax Rates Effective January 1 - March 31 2020.

To calculate sales and use tax only. Quarter 2 2022 April 1 - June 30. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

Decimal degrees between 450 and 49005 Longitude. Download the latest list of location codes and tax rates for cities grouped by county. The current total local sales tax rate in Everett WA is 9800.

Our Good Senator as Guest Speaker on Polytechnic Univer. The motor vehicle saleslease tax also applies when use tax is due on demonstration. Retail Sales and Use Tax.

Quarter 2 2022 April 1 - June 30. Motor vehicle salesleases tax. Washington has recent rate changes Thu Jul 01 2021.

Everett collects a 32 local sales. The december 2020 total local sales tax rate. The state sales tax rate in Washington is 6500.

Youll find rates for sales and use tax motor vehicle taxes and lodging tax. The County sales tax rate is. Open Monday through Thursday.

4205 019 065084 Everson. Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. 2022 2021 2020 2019 2018 2017 2016 Effective 2022 Local sales use tax rates alphabetical by city.

Tax Rates Effective October 1 - December 31 2020. An alternative sales tax rate of 106 applies in the tax region Mill Creek which appertains to zip code 98208. Code Local Rate State Rate Combined.

Click here for a larger sales tax map or here for a. Use our local Tax rate lookup tool to search for rates at a specific address or area in Washington. There is no applicable county tax or special tax.

Location SalesUse Tax CountyCity Loc. Location SalesUse Tax CountyCity Loc. ZIP--ZIP code is required but the 4 is optional.

2022 2021 2020 2019 2018 2017 2016 2015 Effective 2022. 98201 98203 98206 98207 and 98213. Total 77 103.

The sales tax jurisdiction name is Snohomish which may refer to a local government divisionYou can print a 106 sales tax table hereFor tax rates in other cities see Washington sales taxes by city and county. Code Local Rate State Rate Combined. The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business.

As far as sales tax goes the zip code with the highest sales tax is 98204 and the zip. The Washington sales tax rate is currently. Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date.

3703 020 065085 F Fairfield. There are a total of 182 local tax jurisdictions across the state collecting an average local tax of 2373. Look up a tax rate.

Local sales use tax rates by county. Quarter 3 2022 July 1 - Sept. Select the Washington city from the list of cities starting with E.

Tax Rates Effective January 1 - March 31 2020. The 106 sales tax rate in Mukilteo consists of 65 Washington state sales tax and 40999 Mukilteo tax. Lists of local sales use tax rates and changes as well as information for lodging sales motor vehicles sales or leases and annexations.

The average cumulative sales tax rate in Everett Washington is 1006. Sign up for our notification service to get future sales use tax rate. Within Everett there are around 7 zip codes with the most populous zip code being 98208.

Everett WA Sales Tax Rate. Quarter 3 2022 July 1 - Sept. The Everett Sales Tax is collected by the merchant on all qualifying sales made within Everett.

RCW 82080203 imposes an additional tax of three-tenths of one percent 03 on the sale of motor vehicles. 3703 020 065085 F Fairfield. The Sales and Use Tax is Washingtons principal revenue source.

To calculate sales and use tax only. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was also 9800. The Everett Sales Tax is collected by the merchant on all qualifying sales made within Everett. Search by address zip plus four or use the map to find the rate for a specific location.

This includes the rates on the state county city and special levels. 4205 019 065084 Everson. National Integrated Cancer Control Act.

Download the latest list of location codes and tax rates alphabetical by city. With local taxes the total sales tax rate is between 7000 and 10500. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax.

It is comprised of a state component at 65 and a local component at 12 38.

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Guide For Businesses

Washington Sales Tax Guide For Businesses

Washington State Sales Tax Rate Usgeocoder Blog

Washington Tax Rates Rankings Wa State Taxes Tax Foundation

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

Washington Sales Tax Rates By City County 2022

Washington Sales Tax Guide For Businesses

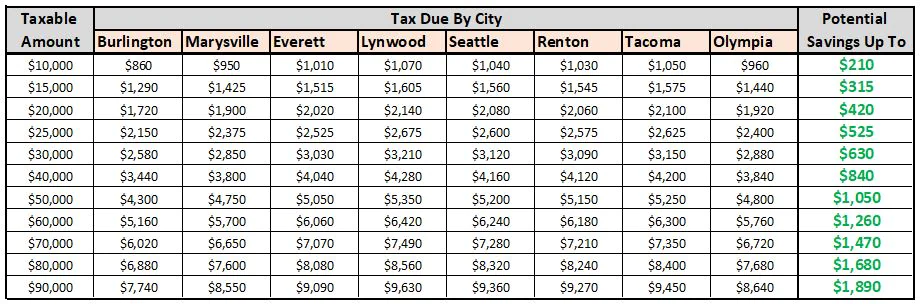

Car Sales Tax Savings Car Incentives In Burlington Wafacebook

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog

What Is The Washington State Vehicle Sales Tax

Cover Letter For Career Change To Teaching Career Change Cover Letter Cover Letter For Resume Career Change Resume