accumulated earnings tax c corporation

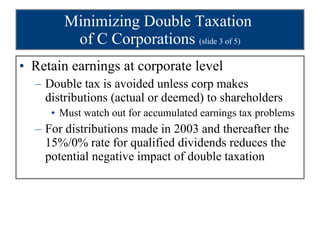

However if a corporation allows earnings to accumulate. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the.

Tax Implications Of Converting From A C Corp To An S Corp Sensiba San Filippo

The tax is assessed at the highest individual tax rate.

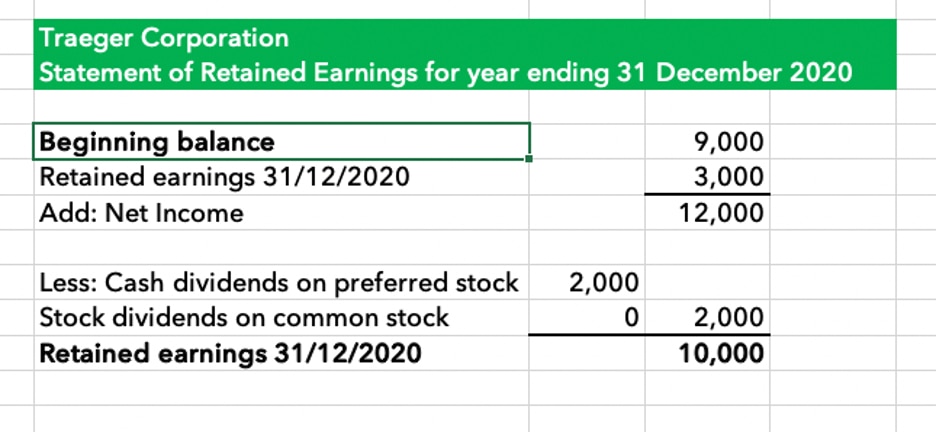

. In January you use the worksheet in the Form 5452 instructions to figure your corporations current year earnings. The accumulated earnings tax is considered a penalty tax to those C corporations that have. JMD Einsidler Management operates over one thousand units in multiple locations all in Suffolk County.

May 17th 2021. What is the Accumulated Earnings Tax. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

City Hall Room 402. Long Beach NY 11561. Distributions are taxable to the shareholder.

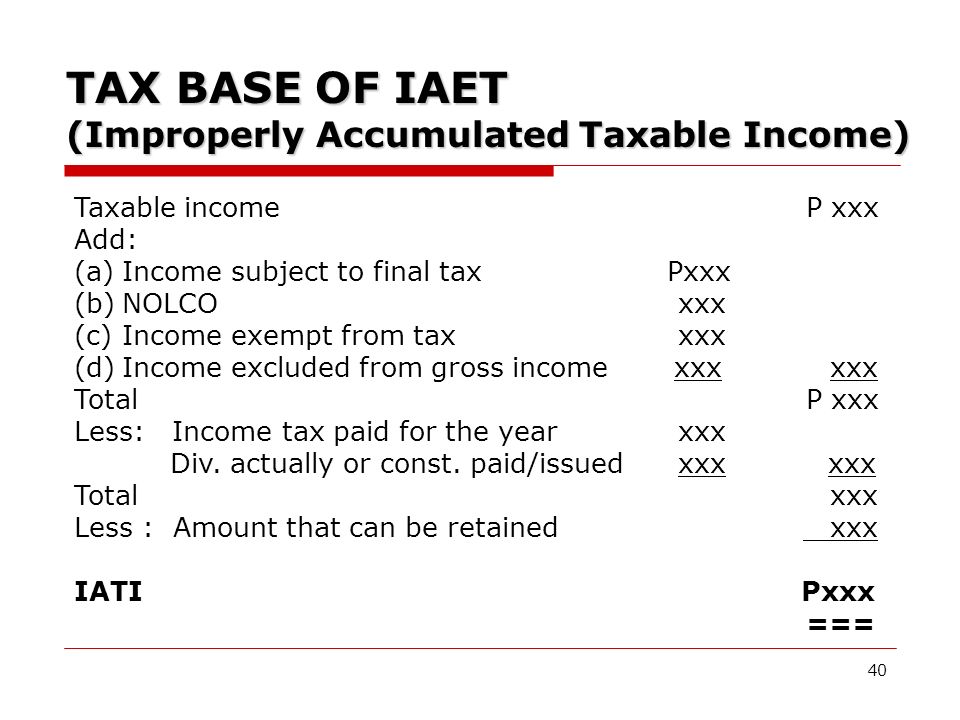

Our corporate home office is located in Melville New YorkJMD Einsidler Management. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends. To trigger the tax you need to suffer an IRS audit that notes your failure to pay dividends when the corporations accumulated earnings exceed 250000 or 150000 for a.

When the C corporation has current retained or accumulated earnings and profits EP non-liquidating corporate distributions to shareholders are considered as taxable. The tax is in addition to the regular corporate income tax and is. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. MEDFORD Ore--BUSINESS WIRE--Oct 21 2022--. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. Publication 542 012019 Corporations - IRS tax forms.

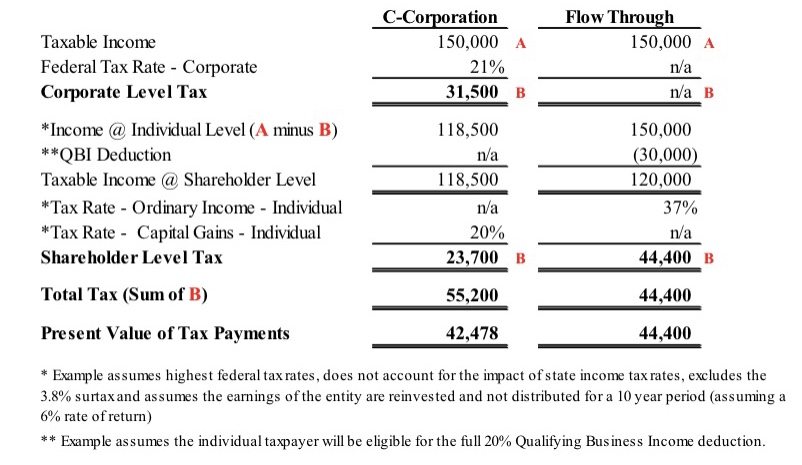

How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. 1 West Chester Street.

The tax consequences of distributions from C corporation depends on the type of the distribution. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes. Which only allow a basis offset if the.

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

M7 P2 Corporate Income Taxation 15b Students Pdf Corporate Tax Gross Income

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

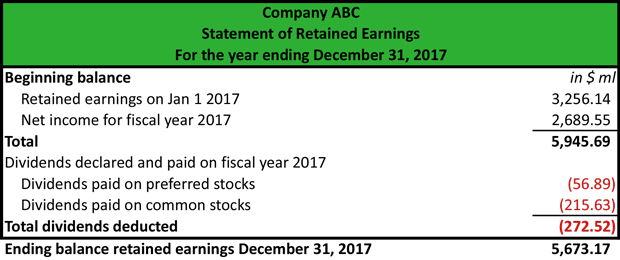

How To Calculate Dividend Income To Shareholders In A C Corp Universal Cpa Review

Are Retained Earnings Taxed For Small Businesses

Reg 2 Corporate Taxation Flashcards Quizlet

Chapter 2 C Corporations Flashcards Quizlet

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

What Are Accumulated Earnings Definition Meaning Example

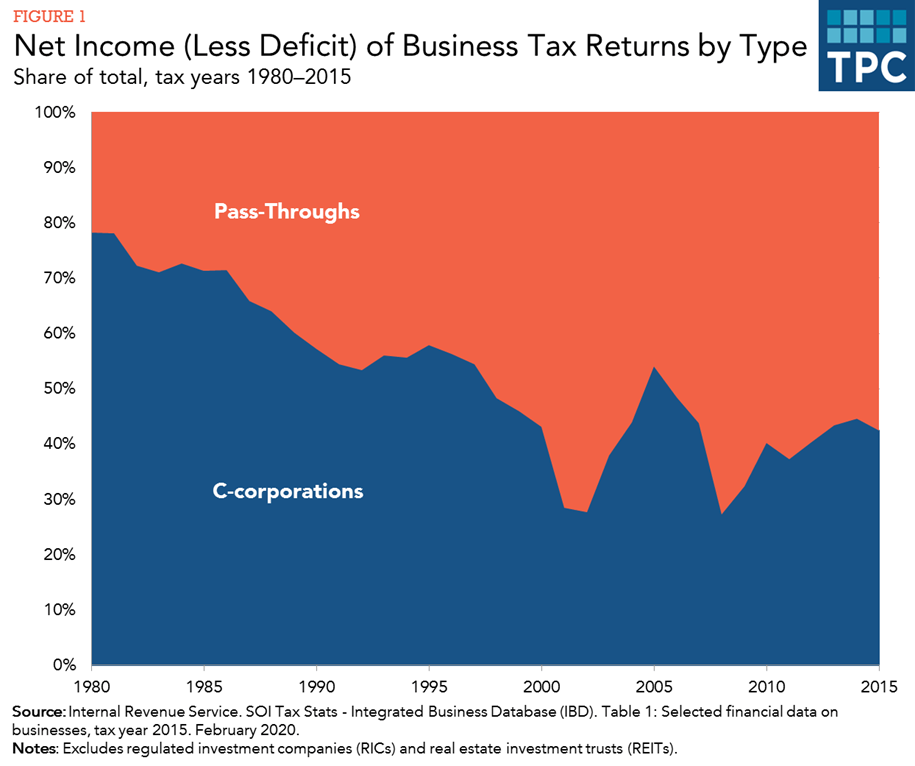

Is Corporate Income Double Taxed Tax Policy Center

What Is Double Taxation A Small Business Guide For C Corps Bench Accounting

1120s504 Form 1120 S Income Tax Return For An S Corporation Page 5 Nelcosolutions Com

Fundamentals Of Federal Taxation Key Terms Chapter 17 Key Terms Accumulated Earnings Tax A Studocu

Double Taxation Of Corporate Income In The United States And The Oecd

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company